An equity valuation aims to mimic the price that would be observed in a marketplace in which the business or equity would trade if it were listed in that marketplace. That marketplace (e.g., ASX) aims to provide to buyers, sellers, brokers and advisers with sufficient information to form a view as to value and, therefore, the price at which the equity should be bought or sold.

Underlying every equity valuation is a valuation of the operating business owned by the equity holders.

As every business is unique and idiosyncratic, the only time that a market price for a business can be observed is at the time of sale.

If your business or company equity were listed on a stock exchange . The qualifier is that if all relevant and price-sensitive information is not available or understood by the capital market then the observed price may not reflect the value of the company’s strategy.

At Peloton, we deal with the question of business and equity value on a daily basis – it is a key component of our service offering.

Mimicking the buyers and sellers operating in deep, real-time capital markets, our work involves three key inputs:

- Understanding the relative competitive position of a business or company

- Interrogating capital market data

- Financial analysis and forecasting

We employ specialised tools, data sources, analysis frameworks and real-world investing experience to support our clients through their valuation processes to deliver reliable and insightful valuations which comply with financial reporting obligations (such as AASB136, AASB2 etc) and ATO Market Valuation Guidelines.

Key ingredients of a equity valuation

What impacts the value of a business or equity interest?

The answer is: a lot!

Whilst at first, it might seem like a simple two-variable equation (the product of future earnings (or cashflows) and a multiple (or discount rate)), a myriad of considerations underpins each of these two variables.

Importantly, the multiple times earnings approach to value is a short-cut which is often used to communicate a company’s value relative to comparable, ASX-listed companies without express consideration of the many factors that influence a more complete forward-looking view of profits and capital market pricing of those expected profits.

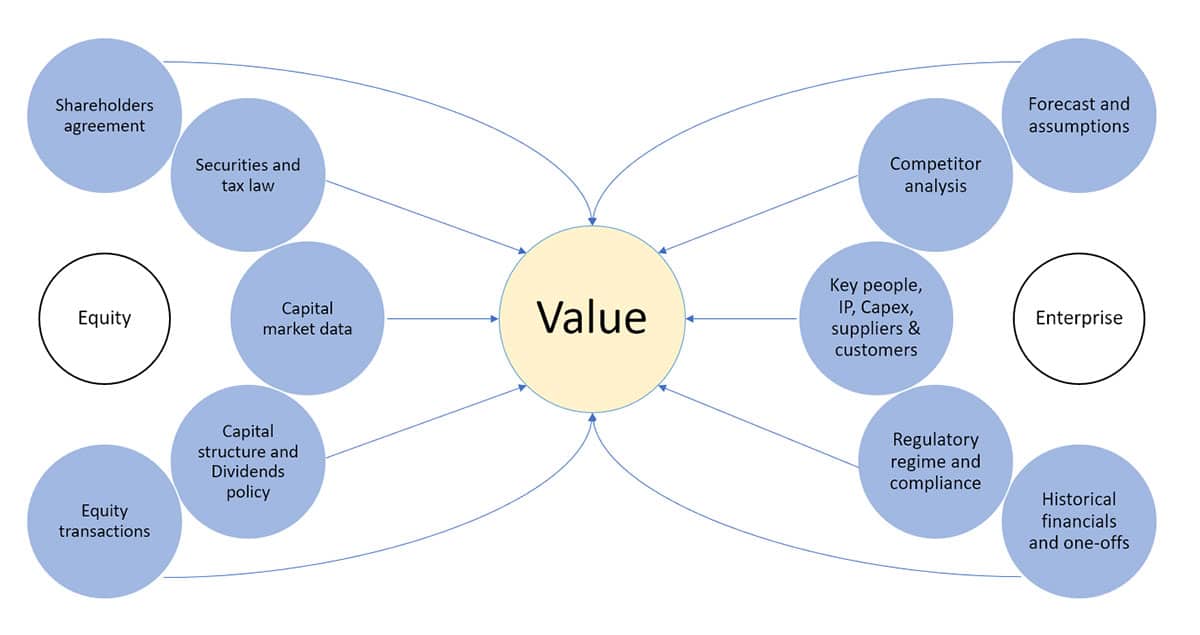

From forecast cashflows to legal agreements which condition how profits flow to owners, the following diagram captures the major factors which influence the two-variable equation:

Capital market view of uncertainty

Established capital markets (think ASX, NASDAQ, ICE, NYSE) are virtual (and sometimes physical) marketplaces where millions of global participants are buying and selling equities, bonds, commodities and derivatives of those instruments 24/7, in real time, with no risk of settlement and with near-contemporaneous exchange between buyers and sellers.

Prices in these markets are informed by evidence as to likely future returns from the particular asset.

The implied returns from these assets are used to explore and assess the likely capital market pricing of an unlisted asset.

The views of buyers and sellers are effectively changing instantaneously as new information becomes available which informs views as to the risk of the likely future returns. This information might be in regard to exchange rates, borrowing costs, availability of labour in a developing country in which the country operates, commodity prices, underlying demand for the company’s products and many more factors.

Given the continuous disclosure regimes in place in every major exchange, the company is obliged to alert market participants to events and information which might materially impact the value (and therefore the price) of the company’s shares. Every market participant is digesting the uncertainty (or resolution of uncertainty) such that all information pertaining to the company is reflected in their view of value and, ultimately, price.

Making sense of the mountain of information that is available with respect to broadly-comparable equities is a key skill that a specialist value analyst employs in assessing the likely pricing of an unlisted equity.

Toolbox

Consistent with the diagram set out earlier, being prepared to undertake a valuation requires certain information to be available and a considered approach to the development of earnings/cashflow forecasts.

The following table sets out the key ingredients to a successful valuation process. This is not a substitute for a detailed information request tailored to the circumstances of a particular business or company.

For example, if the company is at an early-stage of commercialising a new product, typically the valuation will take a deep-dive into the commercialisation plan, competitive landscape, adoption curve, competitive threats and more.

Key considerations in business (enterprise) and equity valuations

| Business or enterprise valuation | Discussion |

| Forecasts | A three-way model (P&L, cashflow and balance sheet) covering a period of time sufficient to arrive at a point where growth is stable |

| Assumptions book supporting forecast model | This should set out the key assumptions underpinning every line item in the forecasts |

| Competitor analysis | Market share, product margins and differentiation are of particular interest |

| Historical financial statements | At least three years |

| Narrative as to one-off or non-recurring items evidenced in the historical financial statements | Examples include legal costs in relation to customer litigation, bad debt expenses arising from contract termination, large items such as patenting which could have been amortised over the life of the benefit |

| Details of regulatory requirements and compliance regime | Example includes license to operate such as financial services licence, mining lease, |

| Capex, R&D, investment in growth initiatives | What ongoing investment is required to efficient operations and competitiveness? |

| Key person contract arrangements | For each key person consider whether termination is mutual, retention arrangements, availability of alternative personnel and/or training time |

| Details of contractual obligations such as supply arrangements on fixed terms | Reliability vs flexibility, cost and liability |

| Description of key IP supporting business operations | This may be ‘soft’ IP such as know-how, critical customer relationships in addition to ‘hard’ IP such as patents, geographic license, |

| Equity valuation | |

| Shareholder agreement | Does the shareholder agreement over-ride normal pre-emptive rights with drag-along/tag-along arrangements? Is there any obligation to pay dividends? How is company strategy set? |

| Dividend policy | Is there an intention to pay a certain level of dividend? |

| Debt arrangements and target capital structure | Are shareholder loans interest-bearing and repayable? If there is a target capital structure, is there an accompanying plan to raise equity capital? |

| Tax compliance, tax assets and liabilities, franking account balance | If the entity is a tax consolidated group is there a subvention agreement between the head entity and subsidiaries? |

| Details of interest rate swaps, foreign exchange contracts, potential litigation | Are there any contingent or contractual liabilities that are not recorded on the face of the balance sheet and how might they manifest? |

| Details of equity raisings (historical and proposed) including any special conditions beyond those set out in the shareholder agreement | Provides evidence of the price that investors are prepared to pay for the company’s equity and calibrates to the shareholder agreement for consideration of minority/control discount/premium |

| Details of any transactions between shareholders in the last three years | Whilst not a substitute for contemporaneous share sales in a deep market such as the ASX, recent transactions are a key cross-check to an income-based valuation |

Conclusions

In this article, we have focussed on why an apparently simple, two-variable equation can become a complex and specialised task in order to reliably assess the value of a business or equity instrument.

A reliable valuation takes into account the inherent risk in earnings forecasts, critical infrastructure which underpins every business (people, IP, customers, plant, suppliers etc) and moves to equity valuation issues covering shareholder agreements and capital structure. The synthesis of all this information provides an income-based valuation which is cross-checked to transaction evidence and capital market data.

The valuation toolbox provides a starting point for the valuation process and a discussion with a valuation specialist will reveal the considerations relating to a specific business and the equity in the entity which owns that business.

Peloton Corporate experience

The specialist team at Peloton Corporate has extensive experience in providing assessments of market value of equity for listed and unlisted companies for various purposes, including financial reporting, IPO’s, impairment testing, investment valuation and regulatory support.

Our experience spans a variety of industries, including financial services, aquaculture, agriculture, infrastructure and many others.

Our team has undertaken over 1,000 valuation engagements which have been relied on for capital raisings, sales, purchases, investment decisions, financial reporting, litigation and employee share schemes.

Buying a new business? Investing in a new project? Starting a new venture? Peloton Corporate employs tools and techniques which will ensure you have a plan to manage for value creation irrespective of the amount of uncertainty you confront. If you require any assistance or advice, please feel free to contact Michael Churchill (mchurchill@peloton.group).