We all know that the RBA has just increased the cash rate for the first time in 10 years.

We might also be familiar with the fact that Australian Government Bonds have been increasing too (currently around 3.5%).

But what has happened to the cost of corporate borrowings?

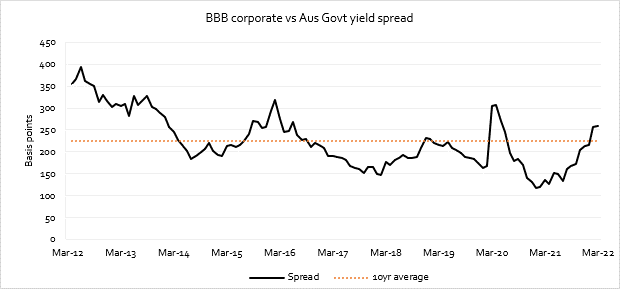

The short answer is that the spread between BBB-rated corporate bonds and Australian Government Bonds has reverted to its 10-year average (plus a bit).

The long-run (10-year) average spread (the interest rate that BBB-rated corporate bonds exhibit relative to bonds) is 225 basis points (bps).

That is, the cost (interest rate) of a long-dated BBB-rated corporate bond is now 5.75% (bond rate of 3.5% plus the spread of 2.25% = 5.75%).

Over the last 10 years, that spread has been as high as 4% (2012) and as low as 1% (during peak-stimulus).