If you are a public company CFO, company director, member of the remuneration committee, remuneration adviser or analyst, then you need to be aware of critical aspects of AASB2 Share based payments as the impact on reported profits can be significant. Read more on the AASB2 here.

It is generally believed that remuneration of key executives and senior management personnel should reflect two primary objectives.

- Attract quality, capable team members

- Retain those team members so long as they perform according to their employment contract

It is also generally believed that senior personnel remuneration should reflect three components:

- Reward for effort

- Reward for performance beyond expectations

- Reward for improving shareholder outcomes

This typically manifests in remuneration structures comprising:

- Fixed or base salary

- Short term incentives (cash bonuses but can sometimes have a component of equity or equity-like instruments) for outperformance of short-term goals

- Long-term incentives (typically equity or equity-like instruments) – usually granted with vesting conditions which align employee reward with shareholder outcomes but can also incorporate “soft” conditions such as the company’s ESG rating, strategic plan execution, preferred employer status etc

The proportion of remuneration allocated to each of these three components varies company to company but typically falls into the following ranges:

- Fixed salary 30-60%

- Short-term incentives 20-50%

- Long-term incentives 10-50%

Example: ListedCo has employed a CIO on a three-year contract on the basis of a fixed salary of $250,000 with annual performance bonus of $150,000 (maximum) and a long-term incentive [“LTI”] comprising 100,000 options to acquire ListedCo shares at a discount of 20% to the closing share price on 30 Jun 2024 provided the CIO remains in the employment of ListedCo at 30 June 2024. No escrow period applies to the shares acquired upon exercise of the options i.e. the CIO is not required to hold the shares acquired after exercise of the options. ListedCo shares trade at $10 at the date of the employment contract and the head of HR has proposed that the LTI contributes $200,000 to the remuneration package.

Whilst the typical larger ASX-listed company will reflect a degree of commonality in remuneration structures, there is no requirement or obligation to adopt or adhere to the mainstream view and many companies choose to depart from the norm for a variety of reasons. Some of those reasons include:

- The company’s business is highly cyclical or seasonal (e.g. agriculture)

- For legacy reasons the company’s share price has been highly volatile

- A takeover or merger is anticipated in the period of key employment contracts

- Proxy advisers or activists have challenged the remuneration arrangements

- The remuneration structure has failed to deliver the attraction/retention objectives

- The remuneration arrangements have encouraged management behaviours which have been inconsistent with shareholder objectives

- The company is involved in mineral exploration and vesting conditions are focussed on upgrading JORC resource and commencing mining operations

- Early-stage technology companies often focus on revenue targets as a proxy for (e.g.) TSR or ROA measures

Any component of remuneration which takes the form of equity or equity-like instruments requires financial reporting in accordance with AASB2 Share based payments.

AASB2 also applies to financial reporting by any company which is considering or working towards IPO. The financial statements in the IPO prospectus or disclosure document will need to retrospectively adopt AASB2 for the period to which the prospectus relates.

This can be an important consideration when discussing recent financial results with brokers and underwriters – particularly if significant equity or equity-like instruments have been recently issued to directors, management and service providers.

Example: UnlistedTechCo proposes to IPO in Q3 FY22 and is preparing its prospectus. In FY19, FY20 and FY21 key personnel were predominantly remunerated in the form of “sweat” equity – issuing a large parcel of options over unissued shares to each of the key personnel. As part of the investigating accountant’s review of financial statements, a AASB2 expense has been assessed of $1m in each of the three preceding years, increasing the pre-AASB2 losses in FY19 and FY20 and turning the pre-AASB2 FY21 result from $500k profit to a loss of $500k. The proposed pre-IPO equity grant in FY22 is also going to reduce reported profit by $2m. UnlistedTechCo’s sponsoring broker insists on a re-pricing of the IPO capital raise as a result of the change to the financial statements.

What does AASB2 do?

AASB2 ensures that remuneration which is provided in the form of shares, options, performance rights or other equity derivatives is expensed as a cost of operations. This is referred to as ‘equity-settled’ payments by AASB2.

Simple example: ListedCo employs a CEO on the basis of a fixed salary and a grant of 500,000 shares each year that the contract is in force with no vesting conditions. AASB2 requires that the fair value of the 500,000 shares is determined at the grant date and expensed through the P&L. At the first grant date the company’s shares were trading on the ASX at $1.25 giving rise to an expense in the first year of $625,000.

AASB2 also governs the issue of equity-like instruments in return for goods and services provided to the company. Unlike equity instruments issued as part of remuneration, equity instruments can sometimes be issued in return for assets. The principles are the same except that instead of an expense to the P&L, the company will recognise the fair value of the asset received in return for the issue of the equity instruments.

The scope of this paper is limited to equity-settled transactions which arise from remuneration arrangements with employees. It should be noted that AASB2 is 59 pages in length and this paper only covers critical aspects of equity grants related to remuneration of key personnel.

It is important to appreciate that AASB2 employs a definition of fair value which differs from AASB13 and the AASB2 definition over-rides AASB13.

The language of AASB and employee incentive schemes (glossary and key terms)

This paper uses terms which are in common use by remuneration advisers and also refers to terms which are defined in AASB2. The table below sets out the meaning of terms that are used in this discussion paper.

| Term | Meaning |

| Awards | Some companies refer to performance rights as “awards” |

| CAGR | Compound annual growth rate |

| Escrow | The requirement to continue to hold equity following vesting |

| Equity-like instruments | This is not a AASB2-defined term – we use this to describe any instrument which is captured by AASB2. It includes options over unissued shares, ordinary shares, a different class of share to ordinary shares, shares with restricted rights, convertible instruments or other instruments you may be considering issuing and will be captured by AASB2 compliance requirements |

| Fair value | Defined in AASB2 as “the amount for which an asset could be exchanged, a liability settled, or an equity instrument granted could be exchanged, between knowledgeable, willing parties in an arms-length transaction” |

| Grant | Refers to the grant of a right to receive equity or equity-like instruments as part of remuneration |

| Grant date | The date of acceptance by an employee of the offer to participate in an equity scheme or the AGM date in the event that shareholder approval is required |

| Hurdles | The conditions upon which equity vests |

| KMP | Key management personnel as defined in the company’s remuneration report |

| LTIP | Long-term incentive plan |

| Market conditions | See page 20 of AASB2: “…a performance condition upon which the exercise price…depends [on].. the market price (or value) of the entity’s equity instruments…” |

| Performance conditions | See page 20 of AASB2 |

| Performance period | Typically the beginning of the financial period in which the grant is made to the vesting date

(often 3 or 5 years) |

| Performance rights | Pseudonym for zero-exercise price options over equity (a free grant of equity subject to satisfying vesting conditions) |

| ROA | Return on assets |

| ROCE | Return on capital employed |

| TSR | Total shareholder return (movement in share price plus dividends) |

| Vesting date | The date upon which the employee becomes entitled to the shares or equity-like instruments |

IFRS equivalent to AASB2

AASB2 is the domestic equivalent of IFRS2.

If you are an SEC-registered entity, listed on a foreign stock exchange or otherwise domiciled outside of Australia, the requirements of IFRS2 and AASB2 are interchangeable (but check with your auditor) .

Visit IFRS2 (requires registration).

Expensing

AASB2 proposes that the fair value of the remuneration payable to an employee is not capable of reliable measurement and therefore requires that the expense which is recognised reflect the fair value of the equity instruments issued to the employee.

Unless vesting conditions apply, the expense arising from the grant of equity will arise in the period of the grant date.

Example: ListedCo makes a grant of shares to its CEO on 30 November 2021. There are no vesting conditions. ListedCo has a financial year ending 30 June. AASB2 requires the fair value of the shares as at 30 November 2021 to be recognised in full in the financial yar ended 30 June 2022 and, if ListedCo reports at the half-year, as at 31 December 2021 (on a pro rata basis).

If vesting conditions apply to the grant of equity instruments, the expense usually arises over the vesting period.

AASB2 contemplates two types of vesting conditions:

- Performance conditions

- Market conditions

A market condition is a vesting hurdle linked to observable share prices or returns. For example: (i) reaching a target share price of $20, (ii) 10-day VWAP exceeding $6, (iii) share price exceeding $3 on five consecutive days, (iv) TSR over the performance period exceeding 20%, (v) the company’s TSR over the performance period being above the 50th percentile of the TSRs of a group of peer stocks.

Generally speaking, a performance condition is a vesting hurdle that is not linked to observable market prices or returns. Performance conditions are often written around accounting numbers. For example: (i) EPS exceeding 15c, (ii) ROA exceeding 12%, (iii) CAGR in ROA over the performance period exceeding 10% pa.

Expensing of an equity grant which is subject to a performance condition occurs over the period in which the performance condition is expected to be met.

Example: UnlistedCo makes a grant of shares to its CEO on 30 November 2021. The shares will only vest if the company achieves ASX listing of its shares by 30 June 2024. AASB2 requires the fair value of the shares on the grant date to be expensed in each of the financial years ending 30 June 2022, 2023 and 2024. If the ASX listing is not achieved as required by the equity grant, the expense in FY24 will include an adjustment for the over-expensing in FY22 and FY23. If the performance condition (ASX listing) is met before 30 June 2024, the period in which the listing occurs will have an accelerated expense (the unexpensed portion of the fair value of the grant as at the date the performance condition is satisfied).

Vesting of a grant subject to market conditions can range in degree of complexity. A simple example of a market condition is that vesting occurs when the company’s shares first trade a target share price.

Example: ListedCo is trading at $3.35 and grants performance rights to its CEO on 30 November 2021. The performance rights will vest when ListedCo shares first trade at a price of $5.50 (a marked-based condition). The performance period expires on 30 June 2024. Taking into account the expected financial performance and both historical and likely future share price volatility, an independent expert values the performance rights by assessing the likelihood of the $5.50 price target being achieved during the performance period. AASB2 requires the expense to be recognised over the performance period, resulting in recognition of an equal expense in each of FY22, FY23 and FY24.

Valuation requirements – equity and options

AASB2 requires assessment of the fair value of any equity or equity-like grants as part of the expense calculation.

This can be a very complex valuation task so it is important to consider the compliance costs when designing the LTIP.

This is particularly so if the reporting entity is not yet listed on the ASX and therefore does not have an observed market price for its shares.

Example: UnlistedCo is an unlisted, public company which proposes to IPO in Q3 FY22. It has granted options to each of its KMP pursuant to a long-term incentive plan adopted by the board in Q2 FY22. The options vest and become exercisable on 30 June 2024. As the company’s shares are not yet quoted on the ASX, AASB2 requires that the valuation of the options take into account the likely share price volatility of UnlistedCo shares post-IPO, the potential dividends foregone by the holders of the options, the value of the company’s shares at the grant date and the likely future share price of UnlistedCo shares at the end of the vesting period.

Companies will often refer to the “gross” or “face” value of an equity grant when announcing (for example) the value of an equity grant to the managing director. This is unlikely to reflect the fair value of the instruments calculated in compliance with AASB2 if there are vesting conditions attaching to the grant. This is referred to as the intrinsic value by AASB2.

Example: ListedCo AGM notice of meeting contains a resolution to approve the grant of equity to the managing director. The intrinsic value is $1,500,000 calculated as 300,000 shares at the last closing price of $5.00.

When the remuneration committee has decided to grant equity subject to (for example) the outcome of a target TSR (in an effort to encourage management performance consistent with shareholder expectations), AASB2 requires a reliable estimate of the outcome as part of the expense calculation. In turn, this will require the company to have prepared financial forecasts which enable consideration of the probability of the company achieving the target TSR.

The task dramatically increases in complexity when the LTIP requires the company achieve a TSR which is no less than the 50th percentile of a peer group of companies.

Example: ListedCo has granted performance rights to each of the KMP which vest on 30 June 2025 subject to the TSR of ListedCo being no less than the 50th percentile of a peer group comprising 10 similar companies. AASB2 requires the assessment of each of the likely future TSR’s of each of ListedCo and the peer group companies. Valuing the Rights granted requires the assessment of likely future TSR’s for ListedCo and each of the peer group companies. In turn, this determines the proportion of Rights that are expected to vest allowing an overall valuation of Rights granted

AASB2 provides extensive guidance with respect to the assessment of fair value of equity options – mostly focussed on the expectation that a Black-Scholes or binomial options pricing model will reliably measure the value of options which are subject to vesting hurdles.

However, Peloton has established that the conventional Black-Scholes and binomial models will inevitably over-expense options subject to vesting conditions. The standard provides no guidance or comment in this regard. It is important to note that the commonly-issued performance rights are, in effect, zero-exercise price options which are usually subject to two or more vesting conditions.

In the article, “Long-term incentive plans – ASX listed companies and performance rights”, Peloton discusses the challenges associated with assessing the fair value of performance rights in compliance with AASB2. Peloton’s approach and methodology has been reviewed by all major audit firms and has been accepted in every instance.

A checklist is set out at the end of this discussion paper which will help you to consider what information may be required in preparation to undertake an assessment of the AASB2 expense.

Adjusting AASB2 expense at the end of a performance period

When equity grants are issued subject to vesting conditions, an adjustment to the AASB2 expense may be required at the end of the performance period if the predicted outcome has resulted in a greater equity expense than actually incurred.

Whether an adjustment is permitted will depend on the extent to which the vesting conditions are market or performance conditions.

If the vesting condition is a performance condition, the amount of the expense can be adjusted at the end of the performance period.

Example: MineralCo issues options with a fair value of $1.2m on 1 July 2021 to key executives with a vesting condition which requires an IPO to occur by 30 June 2023 giving rise to an expense of $400k in each of FY22, F23 and FY24. The IPO occurs on 30 September 2024 resulting in an adjustment to the expense in each of FY22, FY23 and FY24 (nil net expense)

Adjustments arising from the difference between actual and expected outcomes under a market condition cannot be adjusted.

Example 1: TechCo issues performance rights with a fair value of $600k on 30 September 2021 which vest when TechCo share price exceeds $0.30 and expire on 30 June 2023. An expense of $200k is booked in FY22. The share price achieves the target share price on 31 March 2022 and all performance rights vest. An expense of $400k is booked in FY23.

Example 2: TechCo issues performance rights with a fair value of $600k on 30 September 2021 which vest when TechCo share price exceeds $0.30 and expire on 30 June 2023. An expense of $200k is booked in FY22, FY23 and FY24. The share price does not achieve the target share price in the performance period and the performance rights do not vest. The $600k expense booked across the three financial years is not able to be adjusted notwithstanding no shares have been issued.

The distinction between market and performance conditions means that the estimate made at the grant date must carefully balance the need for conservatism but not unnecessarily so as over-expensing equity fair values arising from market conditions will reduce profit without the possibility of winding back the over-expensing in a future reporting period.

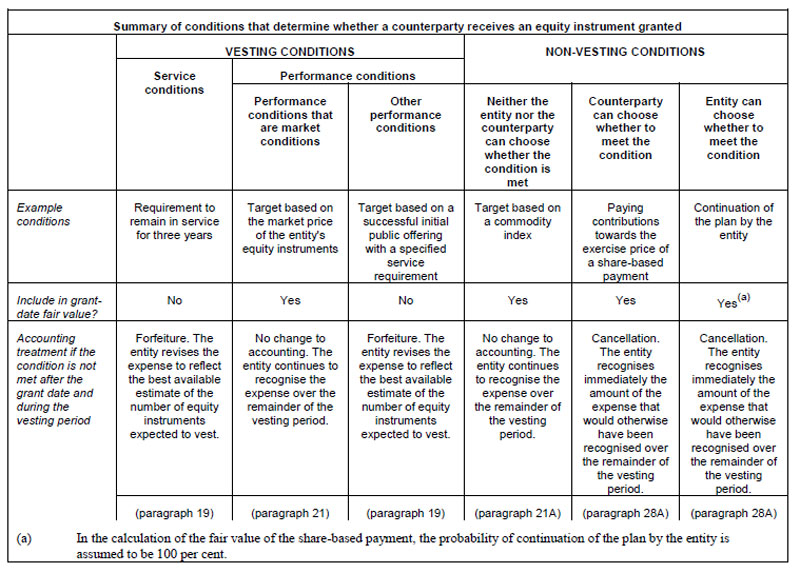

AASB2 provides examples of what is considered a vesting condition, non-vesting condition and whether a vesting condition is a service condition, a market-based performance condition and other performance conditions:

Source: AASB2 page 57

It should be noted that a service condition (e.g. employee remains in the employ of the company for the whole of the performance period) is typically not taken into account when assessing the fair value of an equity grant (i.e. a conservative assumption is made that the employee will be employed by the company at the end of the performance period).

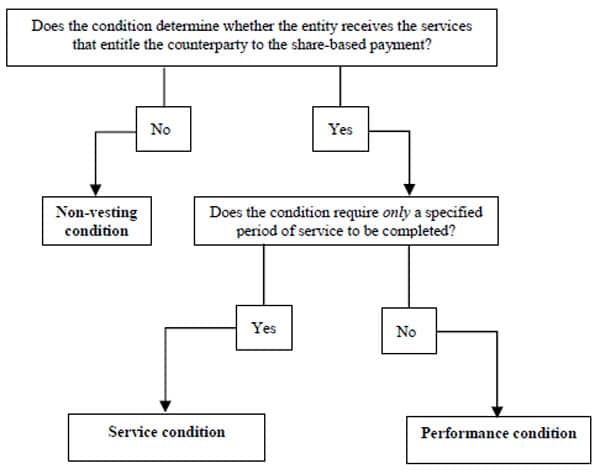

AASB2 sets out a useful decision tree in relation to whether a vesting hurdle is a performance or a service condition:

Source: AASB2 page 34

AASB2 Compliance Checklist

Whether AASB2 expensing is arising for the first time or it has become a regular feature of your financial reporting, there are key matters to consider – some prior to the grant date and some prior to the end of a reporting period. Peloton’s checklist below will help you prepare for and navigate the challenges of AASB2 compliance.

- Does the company propose that remuneration of key personnel include a component of equity or equity-like instruments?

- Are vesting or escrow conditions applied to any equity grant?

- Has consideration been given to performance vs market conditions in the scheme design?

- If the scheme includes performance or market conditions requiring assessment of outcomes (e.g. EBITDA, ROCE, TSR) has the company prepared financial forecasts covering the performance period?

- Has the remuneration committee developed objective bases for assessment of “soft” vesting conditions (e.g. hurdle conditions such as strategic plan execution performance)?

- If the company is an unlisted public company is there a contemporaneous valuation of the issued capital (a contemporaneous, arms-length placement will often be a useful indicator of value)?

- Has the long-term incentive plan [“LTIP”] been approved by the remuneration committee of the board?

- Is the LTIP the same for the managing director and KMP?

- If there is a managing director, has the AGM notice of meeting included a resolution and explanatory memorandum in relation to the equity grant to that director?

- Has the company sought quotes from specialist, independent valuation adviser to perform the fair value assessments?

Conclusions

This discussion paper has focussed on the operation of AASB2 in relation to equity grants made in relation to remuneration of personnel.

There are many other circumstances in which AASB2 compliance is required and we encourage familiarisation with the full standard to determine whether your company is required to report on other transactions (such as grants of equity in relation to successful outcomes arising from the provision of investment banking services).

Most ASX-listed companies have established some form of LTIP.

This is good governance practice in relation to key personnel remuneration.

AASB2 applies to all forms of equity-based LTIP no matter how simple or complex.

The simplest form of LTIP is perhaps described by a grant of equity which vests in the event that a target share price is achieved.

The typical LTIP employed by larger ASX-listed companies is more complex and will often incorporate a range of vesting conditions (both relative and absolute). Examples include:

- Achievement of a relative TSR performance greater than the 50th percentile of a comparable peer group of companies over the performance period (a relative, market condition)

- Achievement of an EPS, ROCE or ROA CAGR target over the performance period (an absolute, performance condition)

- Achievement of outcomes such as an ESG rating, strategic plan execution performance, launch of a new product range etc (absolute, performance conditions)

Few auditors will accept company-prepared attempts at calculating the AASB2 expense and will require a specialist valuation firm undertake the assessment due to the many complex valuation concepts and calculations underlying the AASB2 compliance process.

For more reading, visit Peloton’s AASB2 issues paper, “Long-term incentive plans – ASX listed companies and performance rights”.

Peloton Corporate experience

Over many years, our team has undertaken long-term incentive plan valuations and performance testing for a wide range of ASX listed and unlisted companies including Carbon Revolution, K-Tig, Discovery Metals, IOOF, Tassal, MyState, IP Payments, IconCo, CP2, JCP Investments, Hydrix, Select Harvests and others.